Option Liquidity Solution v4 (OLS4)

What is OLS4 ?

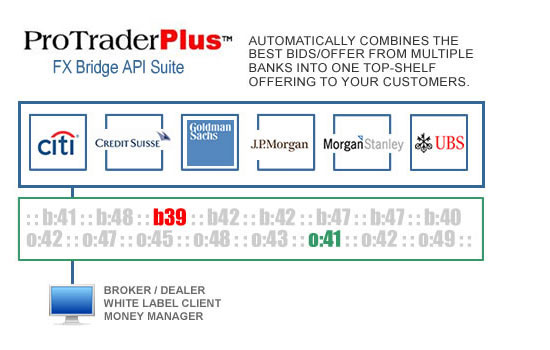

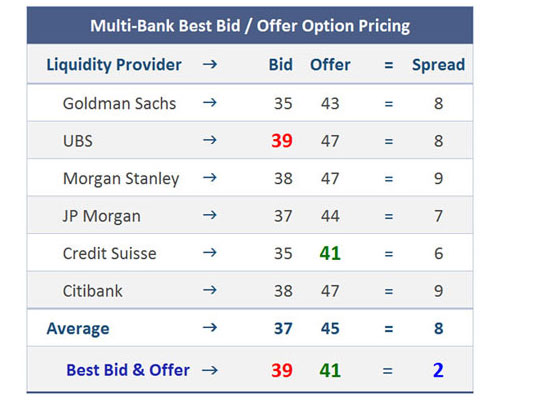

Price aggregation technology providing virtual-streaming, multi-bank best-bid/best-ask executable option pricing & intelligent routing.

FX Bridge’s OLS4 is the solution for third-party platforms to access option liquidity from the world’s largest banks.Multi-bank streaming option price feed

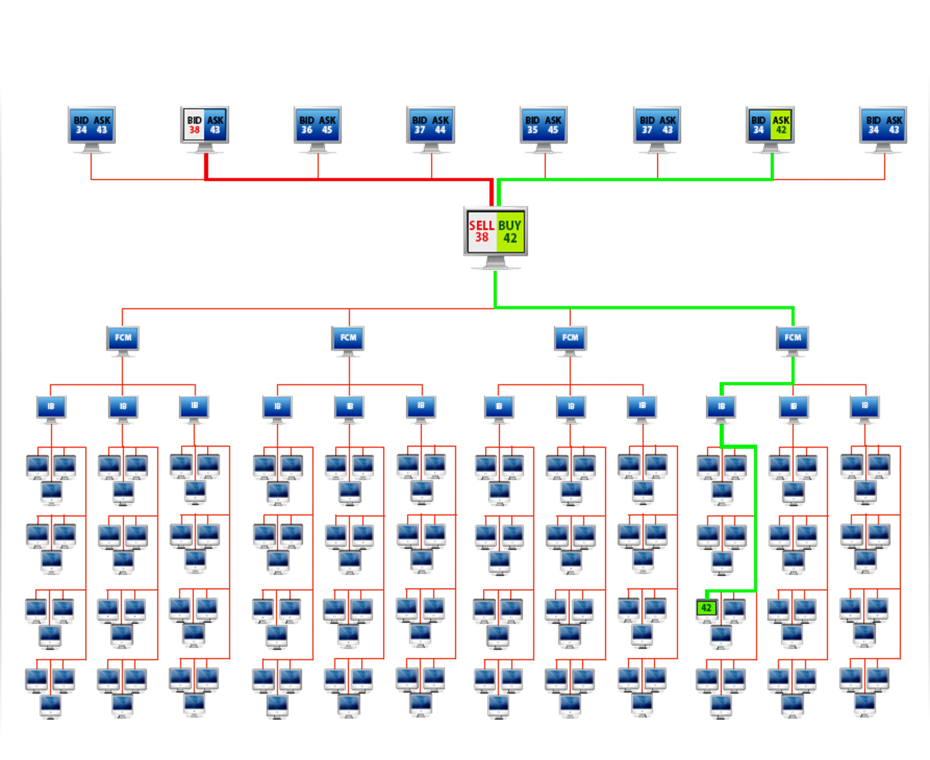

Order matching & smart routing engine

High speed & volume execution API

FX Bridge API Suite delivers “normalized” prices to satisfy standardize retail options demand. Prices are accessible as premium as a single price or array of prices across a range of strikes.

Multi-bank streaming option price feed

Order matching & smart routing engine

High speed & volume execution API

Choice of premium or volatility pricing

Choice of standard or custom strikes/expiries

Price tuning & spread management

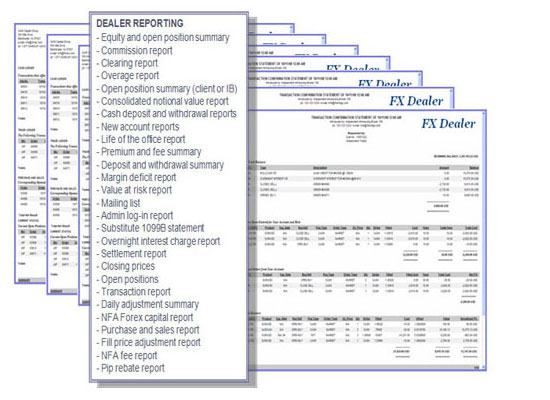

Comprehensive management reporting

Dodd-Frank compliant option ECN/SEF

FX Bridge API Suite “flexible” prices satisfies commercial and institutional demand as well. Prices are accessible as premium, volatility, as single vanilla option, or as a multi-leg combination.

Best Type of Option for Retail Business

Standardized “exchange-style” option

Fixed quantity

Fixed strike prices

Fixed expirations

Tradable (opening & closing orders)

Long & short positions

Why Exchange-style Options?

Proven trading product in equities

Proven trading product in futures

History of success with retail traders

Advantages for Dealers

More profitable than exchange-traded options

Differentiates dealers from competitors

Broad trader appeal & stickiness

Preserves trader equity

Same account spot & options trading

Cross asset margining

Advantages for Traders

Simple & easy to use

Limited risk

Staying power

More trading strategies

More risk management strategies

Preserves equity

Cross-asset margining

Benefits to Market Makers

Contribute to multi-bank option liquidity feed

Choose to route trade flow to internal risk book

Expand offering to other B/Ds thru API

Benefits to Market Takers

Single-screen streaming BBO price discovery

Trade compressed spreads

Choice to trade volatility and/or premium

Immediate automated execution, not RFQ